CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 94

32 Financial risk management and fair values

(continued)

The Group’s exposure to these risks and the financial risk management policies and practices used by the

Group to manage these risks are described below.

(a) Credit risk

Credit risk represents the potential loss that may arise from a customer or counterparty’s failure

to meet its obligation when due. For loan business, the Group identifies and manages the credit

risk through its target markets definitions, credit approval process, post-disbursement monitoring

and remedial management procedures. In respect of treasury businesses, credit risk mainly

represents impairment losses of debt securities due to default by issuers, and inability of derivative

counterparties in fulfilling their obligations. The Group sets credit limits for treasury activities and

monitors them regularly with reference to the fair values of the relevant financial instruments.

The Group is also confronted with credit risk resulting from receivables that arising from sale of goods

and rendering of services within the non-financial services segments. The relevant subsidiaries have

established a credit policy under which individual credit evaluations are performed on all customers

to determine the credit limit and terms applicable to the customers. These evaluations focus on the

customers’ financial position, the external ratings of the customers and their bank credit records

where available.

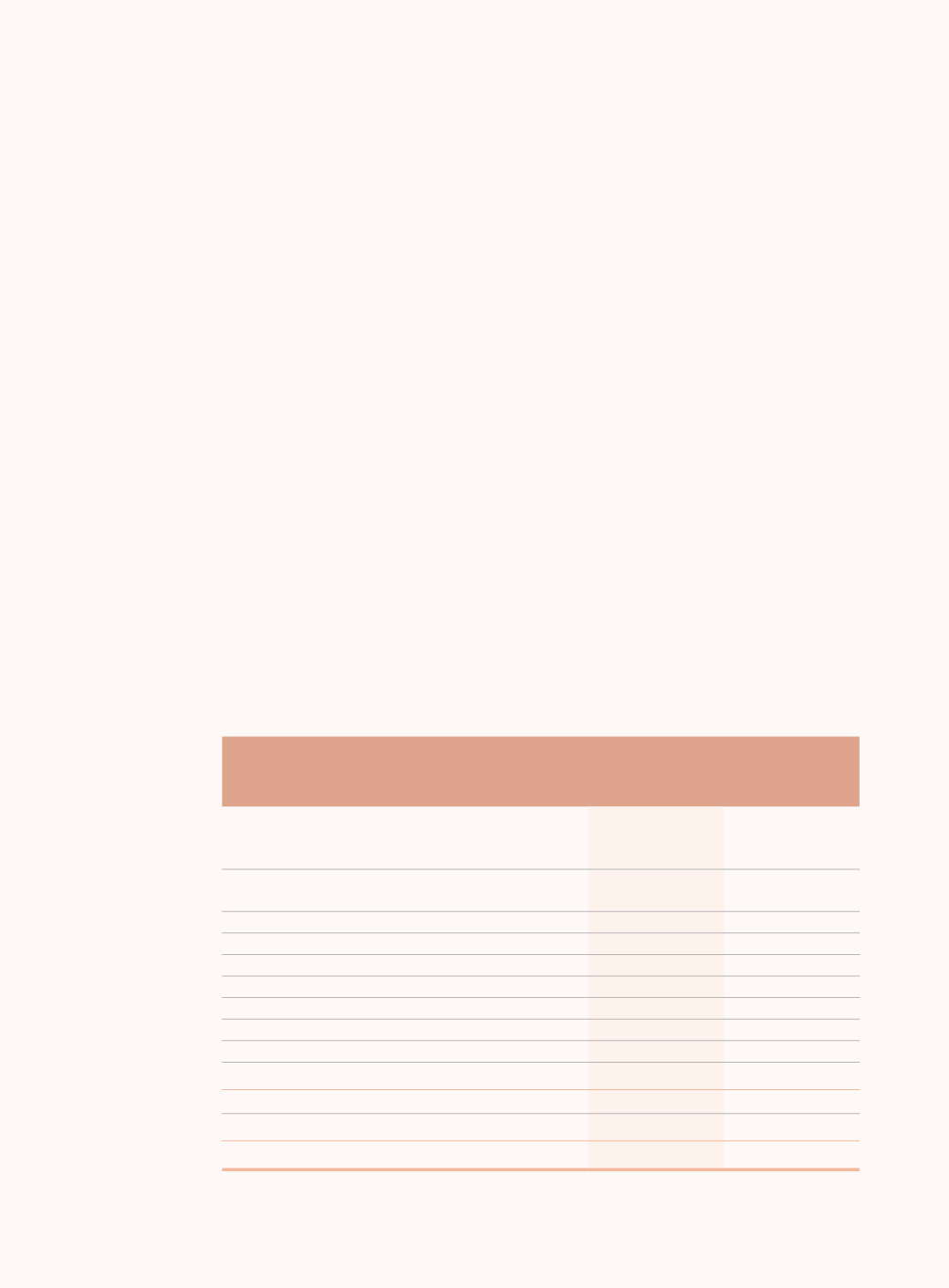

(i) Maximum credit risk exposure

The maximum exposure to credit risk as at the balance sheet date without taking into

consideration of any collateral held or other credit enhancement is represented by the net

balance of each type of financial assets in the balance sheet after deducting any impairment

allowance. A summary of the maximum exposure is as follows:

30 June

2016

31 December

2015

HK$ million

HK$ million

Deposits with central banks, banks and

non-bank financial institutions

865,589

792,788

Placements with banks and non-bank

financial institutions

128,762

141,775

Financial assets at fair value through profit or loss

71,538

33,682

Derivative financial assets

26,976

16,509

Trade and other receivables

110,175

118,008

Financial assets held under resale agreements

113,199

165,391

Loans and advances to customers and other parties

3,153,019

2,947,798

Available-for-sale financial assets

517,843

449,769

Held-to-maturity investments

225,507

216,267

Investments classified as receivables

1,380,912

1,331,281

6,593,520

6,213,268

Credit commitments and guarantees provided

1,453,653

1,475,150

Maximum credit risk exposure

8,047,173

7,688,418