HALF-YEAR REPORT 2016

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 97

32 Financial risk management and fair values

(continued)

(a) Credit risk

(continued)

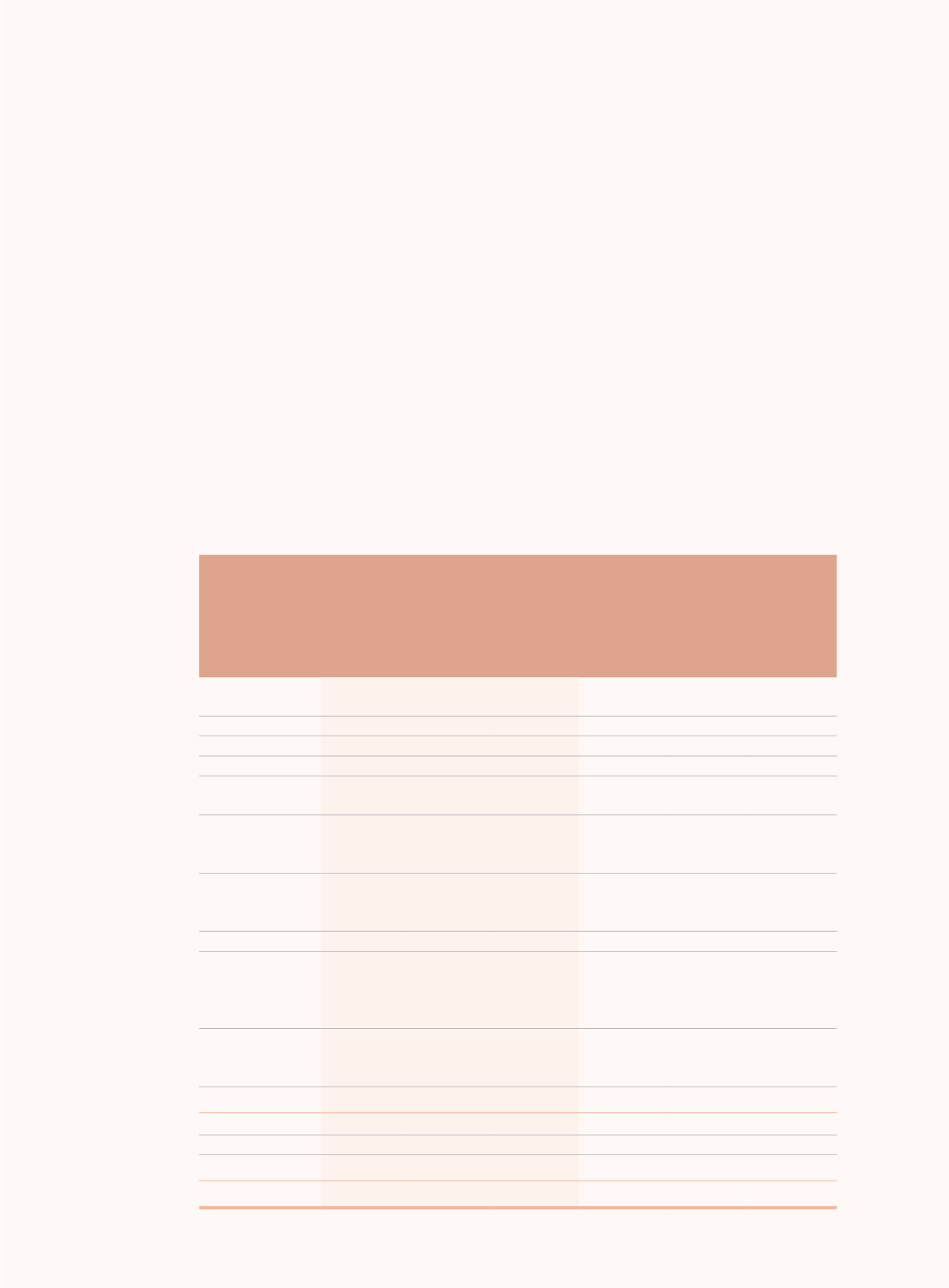

(ii) Distribution by credit exposure is as follows

(continued)

:

Notes:

(1)

Collateral and other credit enhancements for overdue but not impaired loans and advances

As at 30 June 2016, the corporate loans and advances of the Group which were overdue but not impaired were

HK$60,468 million (31 December 2015: HK$36,693 million). As at 30 June 2016, the secured portion of these loans and

advances were HK$35,987 million (31 December 2015: HK$21,471 million), and the remaining loans and advances were

unsecured.

The fair value of collateral held against these loans and advances amounted to HK$43,779 million as at 30 June 2016 (31

December 2015: HK$28,290 million).

The fair value of collateral was estimated by management based on the latest available external valuations, if any,

adjusted by taking into account the current realisation experience as well as market situation.

(2)

The balance represents collectively assessed allowance for impairment losses.

(iii) Loans and advances to customers and other parties analysed by industry sector:

As at 30 June 2016

As at 31 December 2015

Gross

balance

Loans and

advances

secured by

collateral

Gross

balance

Loans and

advances

secured by

collateral

HK$ million

% HK$ million

HK$ million

% HK$ million

Corporate loans

– Manufacturing

487,968

15% 247,544

494,368

17% 240,563

– Real estate

352,727

11% 303,596

307,585

10% 261,357

– Wholesale and retail

299,809

9% 185,796

311,149

10% 192,861

– Rental and business

services

189,569

6% 112,009

176,416

6% 103,917

– Transportation,

storage and postal

services

184,784

6% 94,790

176,102

6%

86,347

– Water, environment

and public utility

management

166,081

5% 83,900

152,110

5%

76,776

– Construction

120,610

4% 54,698

122,469

4%

57,306

– Production and

supply of electric

power, gas and

water

69,829

2% 25,120

65,296

2%

24,134

– Public management

and social

organisations

25,885

1%

5,725

24,869

1%

5,825

– Others

297,011

9% 124,941

284,921

9% 116,578

2,194,273

68% 1,238,119

2,115,285

70% 1,165,664

Personal loans

940,787

29% 689,900

798,078

26% 571,250

Discounted bills

92,853

3%

–

110,721

4%

–

3,227,913

100% 1,928,019

3,024,084

100% 1,736,914