CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 98

32 Financial risk management and fair values

(continued)

(a) Credit risk

(continued)

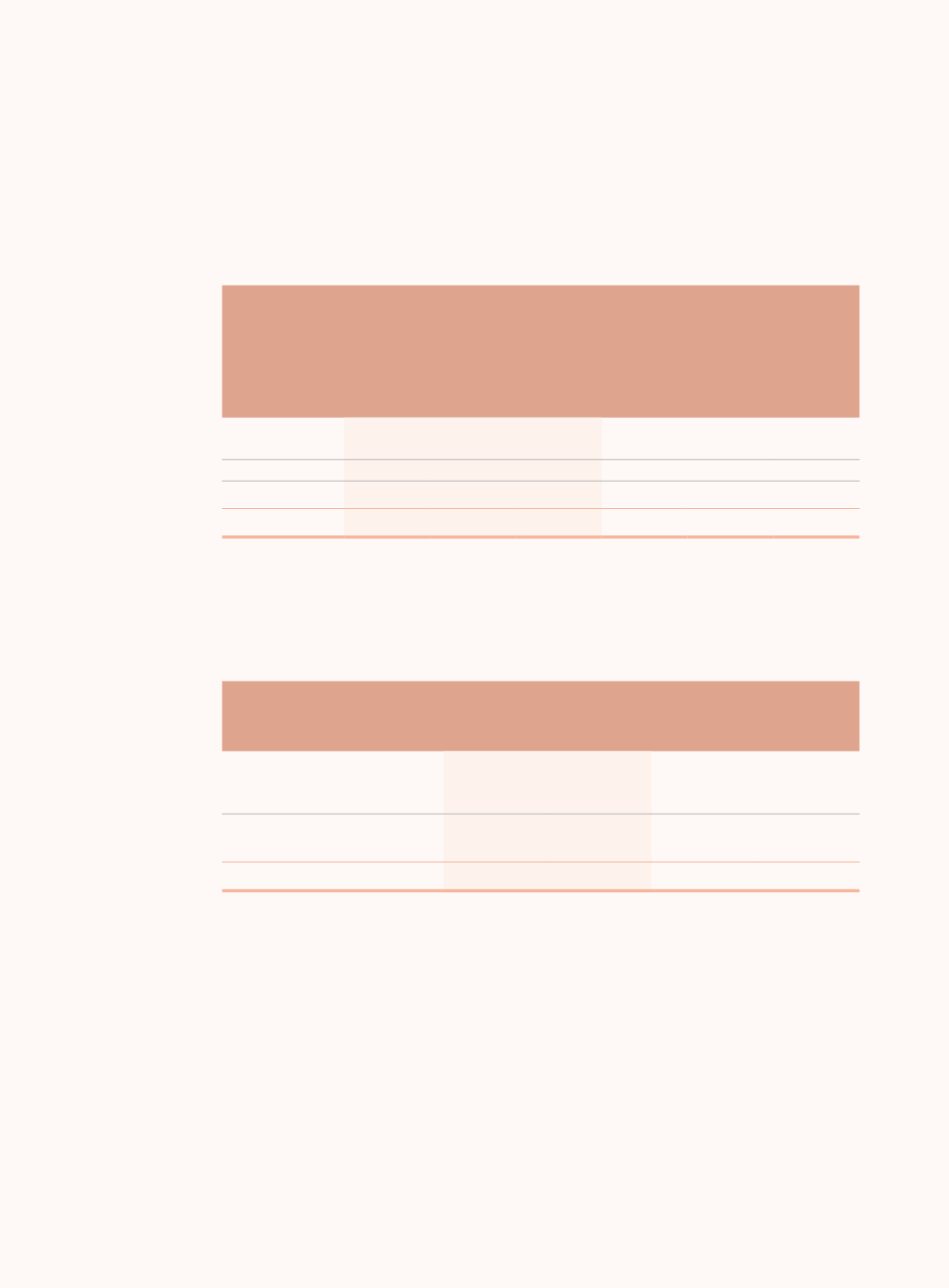

(iv) Loans and advances to customers and other parties analysed by geographical

sector:

As at 30 June 2016

As at 31 December 2015

Gross

balance

Loans and

advances

secured by

collateral

Gross

balance

Loans and

advances

secured by

collateral

HK$ million

% HK$ million

HK$ million

% HK$ million

Mainland China

3,051,511

94% 1,851,067

2,852,755

94% 1,665,593

Hong Kong and Macau

157,157

5% 63,338

146,504

5%

55,634

Overseas

19,245

1% 13,614

24,825

1%

15,687

3,227,913

100% 1,928,019

3,024,084

100% 1,736,914

(v) Rescheduled loans and advances to customers and other parties

Rescheduled loans and advances are those loans and advances which have been restructured or

renegotiated because of deterioration in the financial position of the borrower, or of the inability

of the borrower to meet the original repayment schedule and for which the revised repayment

terms are a concession that the Group would not otherwise consider.

As at 30 June 2016

As at 31 December 2015

Gross balance % of total loans

Gross balance % of total loans

HK$ million and advances

HK$ million and advances

Rescheduled loans and advances

overdue less than 3 months

3,845

0.12%

3,786

0.13%

Rescheduled loans and advances

overdue more than 3 months

6,960

0.22%

6,339

0.21%

10,805

0.34%

10,125

0.34%

(vi) Offsetting

Financial assets and financial liabilities are offset and the net amount is reported in the balance

sheet when there is a legally enforceable right to offset the recognised amounts and there is an

intention to settle on a net basis, or realise the asset and settle the liability simultaneously.

As at 30 June 2016, the Group did not enter into enforceable master netting arrangements

with counterparties and therefore there were no offsettings of any assets and liabilities in the

consolidated balance sheet (31 December 2015: Nil).