CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 102

32 Financial risk management and fair values

(continued)

(c) Interest rate risk

(continued)

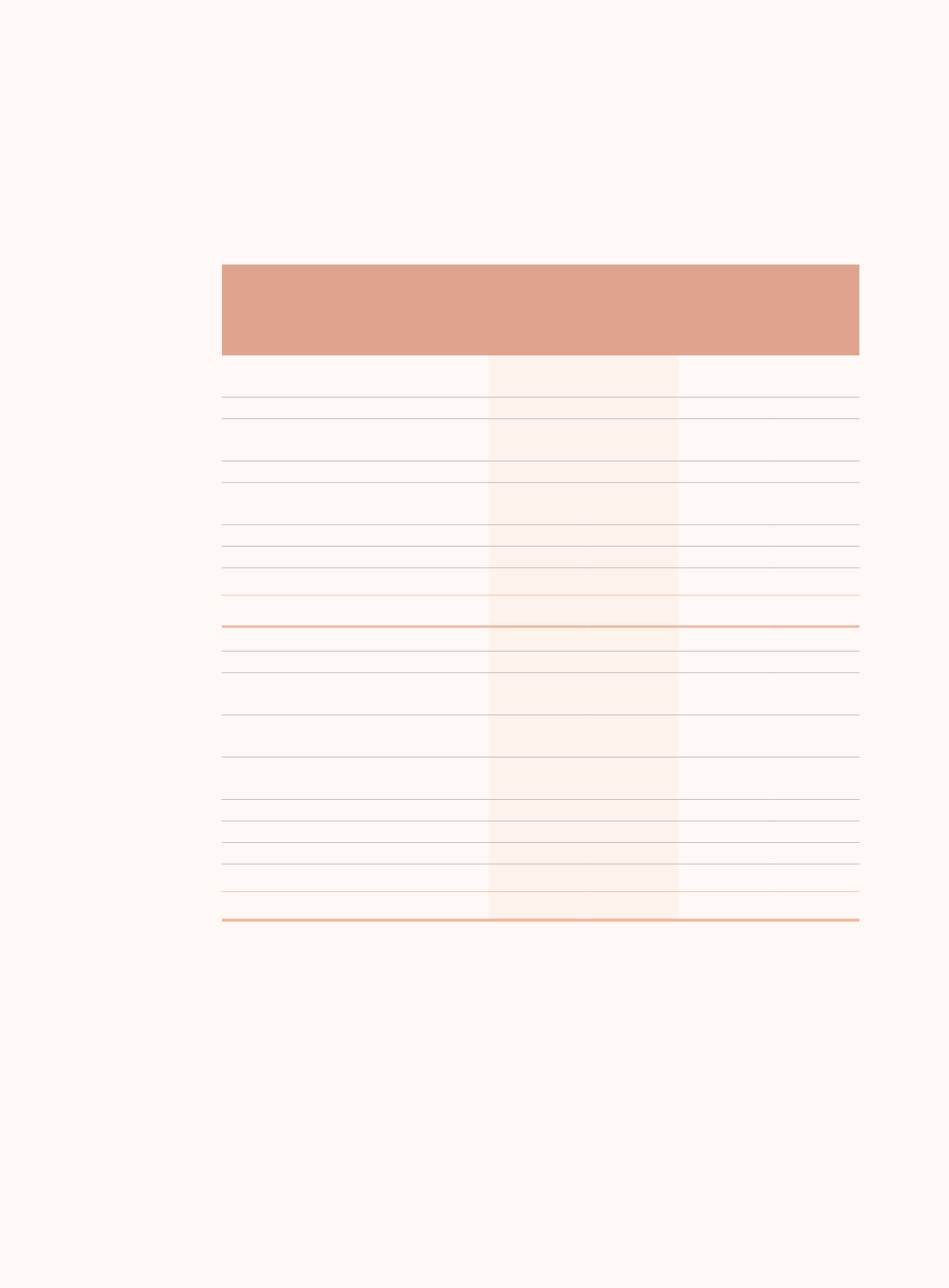

(ii) Effective interest rate

Effective

interest rate

As at

30 June

2016

Effective

interest rate

As at

31 December

2015

HK$ million

HK$ million

Assets

Cash and deposits

1.31%-1.54% 873,526

1.22%-1.47% 801,615

Placements with banks and non-bank

financial institutions

2.59% 128,762

2.59% 141,775

Financial assets held under resale agreements

2.33% 113,199

3.90% 165,391

Loans and advances to customers and

other parties

4.96% 3,153,019

5.85% 2,947,798

Investments classified as receivables

4.11% 1,380,912

5.20% 1,331,281

Investments (note (1))

3.63% 937,518

3.86% 824,808

Others

677,881

590,641

7,264,817

6,803,309

Liabilities

Borrowing from central banks

3.08% 91,380

3.50% 44,761

Deposits from banks and non-bank

financial institutions

2.88% 1,339,053

3.80% 1,275,421

Placements from banks and non-bank

financial institutions

2.19% 56,813

1.81% 58,141

Financial assets sold under repurchase

agreements

2.49% 22,536

2.43% 84,949

Deposits from customers

1.77% 4,010,328

2.16% 3,766,848

Bank and other loans

0.31%-7.86% 110,779

0.63%-8.50% 147,221

Debt instruments issued

2.55%-7.25% 609,098

1.00%-7.25% 449,772

Others

369,213

313,027

6,609,200

6,140,140

Note:

(i)

The Group’s investments include financial assets at fair value through profit or loss, available-for-sale financial assets,

held-to-maturity investments, and interests in associates and joint ventures. The calculation of effective interest rate is

based on the interest yielding part of the financial assets.