CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 106

32 Financial risk management and fair values

(continued)

(e) Fair values

(continued)

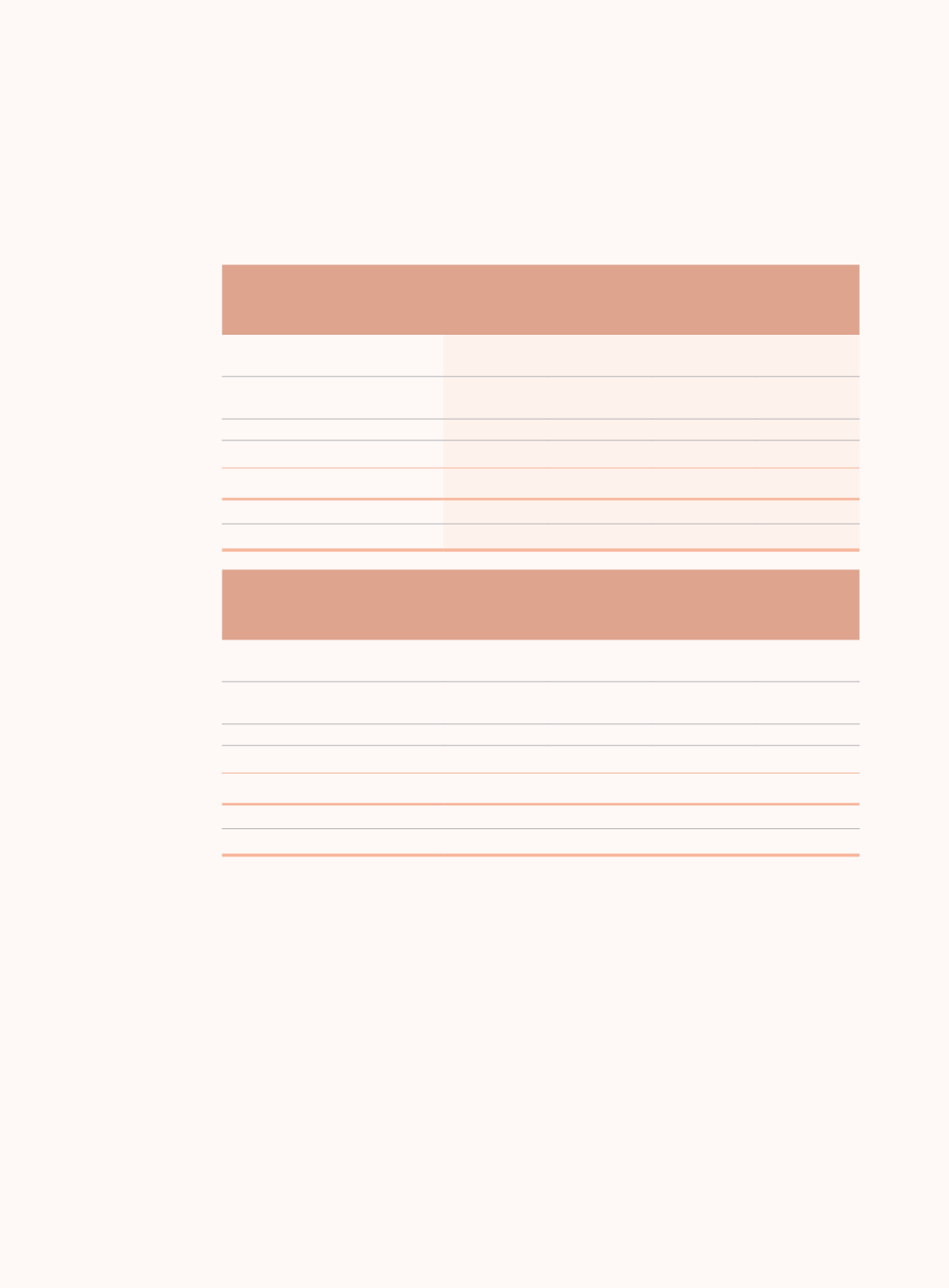

(i) Financial instruments carried at fair value

(continued)

As at 30 June 2016

Level 1

Level 2

Level 3

Total

HK$ million HK$ million HK$ million HK$ million

Assets

Financial assets at fair value

through profit or loss

4,157

70,093

35

74,285

Derivative financial assets

34

26,936

6

26,976

Available-for-sale financial assets

54,447

492,381

18,152

564,980

58,638

589,410

18,193

666,241

Liabilities

Derivative financial liabilities

(13)

(31,960)

(874)

(32,847)

As at 31 December 2015

Level 1

Level 2

Level 3

Total

HK$ million

HK$ million

HK$ million

HK$ million

Assets

Financial assets at fair value

through profit or loss

4,713

35,597

81

40,391

Derivative financial assets

20

16,485

4

16,509

Available-for-sale financial assets

57,070

417,381

18,911

493,362

61,803

469,463

18,996

550,262

Liabilities

Derivative financial liabilities

(1)

(16,566)

(908)

(17,475)

During the six months ended 30 June 2016, there were no significant transfers between

instruments in different levels (six months ended 30 June 2015: Nil) and no significant changes

in valuation techniques for determining the fair values of the instruments (six months ended 30

June 2015: Nil).