CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 110

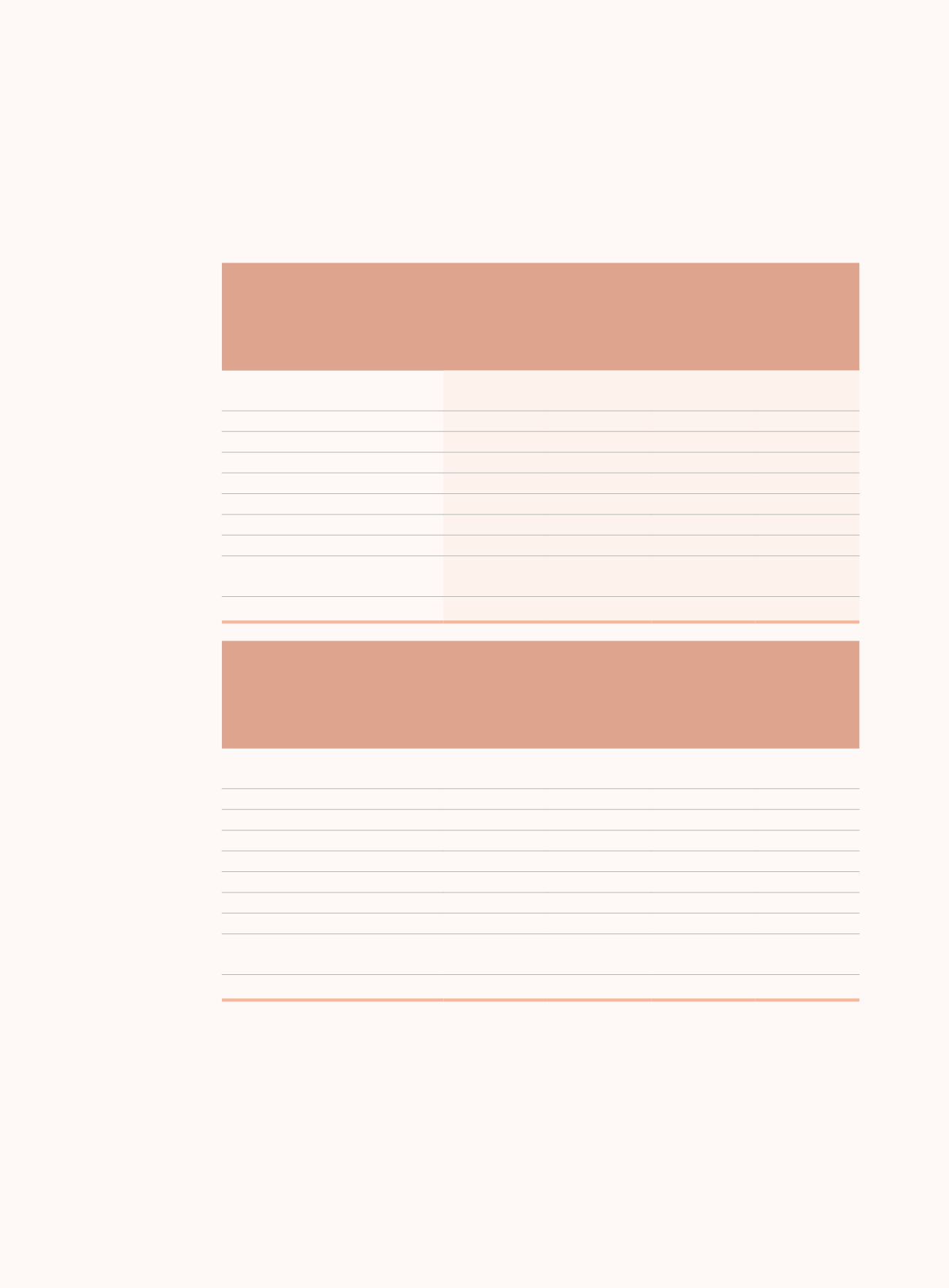

33 Material related party

(continued)

(b) Related party transactions

(i) Transaction amounts with related parties

Six months ended 30 June 2016

Parent

company

Holding

company’s

fellow entities

Associates and

joint ventures

Total

HK$ million HK$ million HK$ million HK$ million

Sales of goods

–

13

5

18

Purchase of goods

–

9

37

46

Interest income (note (2))

9

83

110

202

Interest expenses

3

19

208

230

Fee and commission income

–

6

18

24

Fee and commission expenses

–

–

3

3

Income from other services

–

43

40

83

Expenses for other services

–

222

4

226

Interest income from deposits

and receivables

–

32

63

95

Other operating expenses

–

10

19

29

Six months ended 30 June 2015

Parent

company

Holding

company’s

fellow entities

Associates and

joint ventures

Total

HK$ million

HK$ million

HK$ million

HK$ million

Sales of goods

–

133

–

133

Purchase of goods

–

4

12

16

Interest income (note (2))

8

27

21

56

Interest expenses

165

9

195

369

Fee and commission income

–

2

50

52

Fee and commission expenses

–

–

47

47

Income from other services

–

18

8

26

Expenses for other services

–

265

26

291

Interest income from deposits

and receivables

–

44

2

46

Other operating expenses

–

1

65

66

Notes:

(1)

These above transactions with related parties were conducted under the normal commercial terms.

(2)

Interest rates of loans and advances to the related parties were determined at rates negotiated between the Group and

the corresponding related parties on a case by case basis.

(3)

During the relevant periods, CITIC Bank, a subsidiary of the Group, entered into transactions with related parties in the

ordinary course of its banking businesses including lending, assets transfer, wealth management, investment, deposit,

clearing and off-balance sheet transactions. These banking transactions were conducted under normal commercial terms

and conditions and priced at the relevant market rates prevailing at the time of each transaction.