CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 104

32 Financial risk management and fair values

(continued)

(d) Currency risk

(continued)

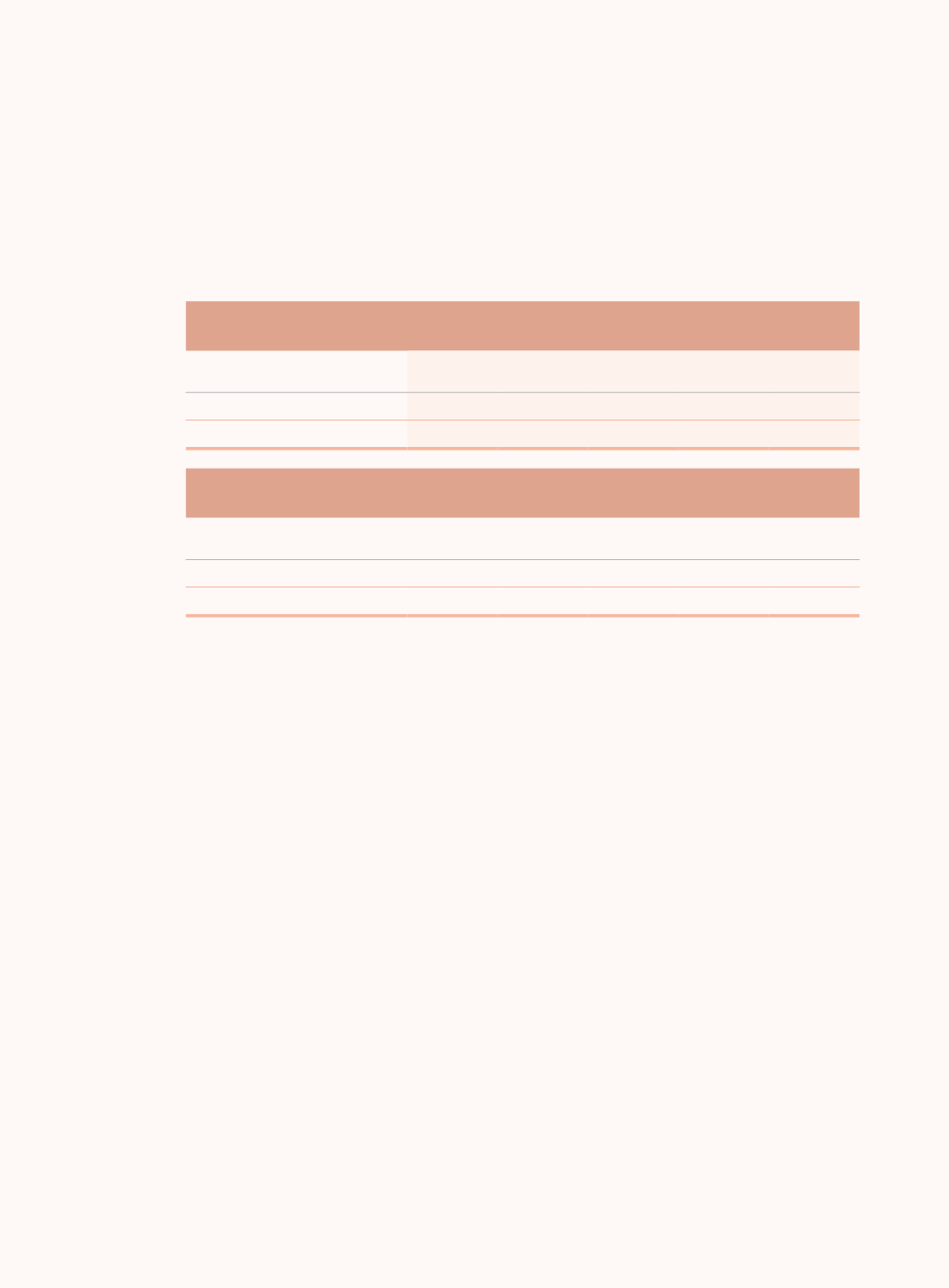

The exposure to currency risk arising from the financial assets and financial liabilities at the balance

sheet date is as follows (expressed in HK$ million):

As at 30 June 2016

HK$

US$

RMB

Others

Total

Total financial assets

161,882

353,893

6,089,739

45,918

6,651,432

Total financial liabilities

(163,390)

(452,303)

(5,783,410)

(60,882)

(6,459,985)

Financial asset-liability gap

(1,508)

(98,410)

306,329

(14,964)

191,447

As at 31 December 2015

HK$

US$

RMB

Others

Total

Total financial assets

142,259

358,265

5,729,973

43,324

6,273,821

Total financial liabilities

(137,807)

(437,680)

(5,403,623)

(67,486)

(6,046,596)

Financial asset-liability gap

4,452

(79,415)

326,350

(24,162)

227,225

The Group uses sensitivity analysis to measure the potential effect of changes in foreign currency

exchange rates on the Group’s profit or loss.

Assuming all other risk variables remained constant, a 100 basis points strengthening or weakening

of HK$ against the US$, RMB and other currencies as at 30 June 2016 would decrease or increase

the Group’s annualised profit before taxation by HK$1,930 million (31 December 2015: decrease or

increase the Group’s annual profit before taxation by HK$2,228 million).

This sensitivity analysis is based on a static foreign exchange exposure profile of financial assets

and financial liabilities and certain simplified assumptions. The analysis is based on the following

assumptions: (1) the foreign exchange sensitivity is the gain and loss recognised as a result of 100

basis points fluctuation in the foreign currency exchange rates against HK$; and (2) the exchange

rates against HK$ for all foreign currencies changes in the same direction simultaneously and does not

take into account the correlation effect of changes in different foreign currencies; and (3) the foreign

exchange exposures calculated include both spot foreign exchange exposures, forward foreign

exchange exposures and options, and all positions will be retained and rolled over upon maturity. The

analysis does not take into account the effect of risk management measures taken by management.

Because of its hypothetical nature with the assumptions adopted, actual changes in the Group’s profit

before taxation resulting from increases or decreases in foreign exchange rates may differ from the

results of this sensitivity analysis.