HALF-YEAR REPORT 2016

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 89

31 Contingent liabilities and commitments

(continued)

(c) Bond redemption obligations

As an underwriting agent of PRC government bonds, CITIC Bank has the responsibility to buy back

those bonds sold by it should the holders decide to early redeem the bonds held. The redemption

price for the bonds at any time before their maturity dates is based on the coupon value plus any

interest unpaid and accrued up to the redemption date. Accrued interest payables to the bond

holders are calculated in accordance with relevant rules of the Ministry of Finance and the People’s

Bank of China. The redemption price may be different from the fair value of similar instruments traded

at the redemption date.

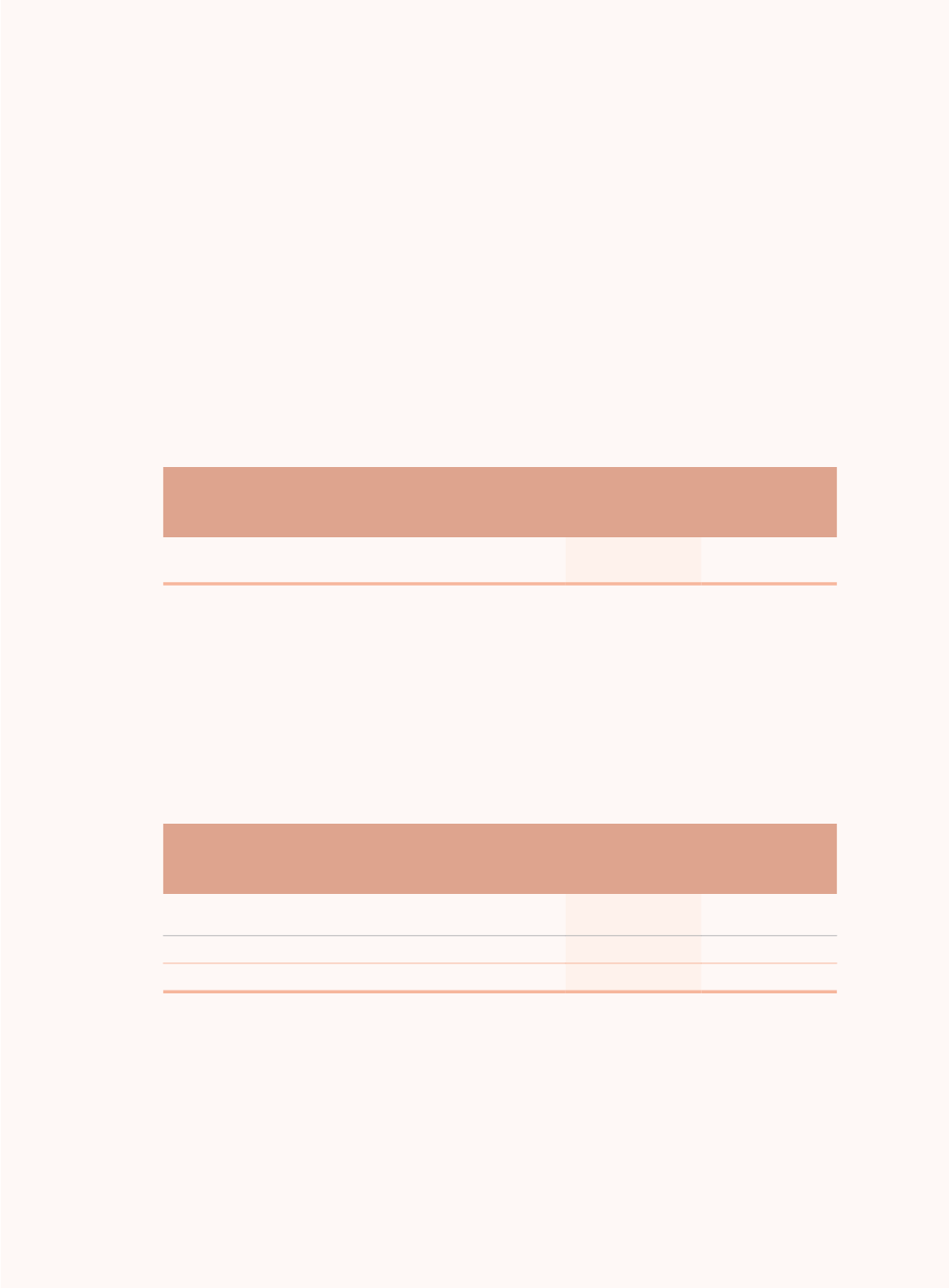

The redemption obligations below represent the nominal value of government bonds underwritten

and sold by CITIC Bank, but not yet matured as at the balance sheet date:

30 June

2016

31 December

2015

HK$ million

HK$ million

Bonds redemption obligations

15,027

15,960

As at 30 June 2016, the original maturities of these bonds vary from one to five years (31 December

2015: one to five years). Management of the Group expects the amount of redemption before

maturity dates of these bonds will not be material. The Ministry of Finance will not provide funding for

the early redemption of these bonds on a back-to-back basis, but will settle the principal and interest

upon maturity.

(d) Guarantees provided

Except for guarantees that have been recognised as liabilities, the guarantees issued by the Group as

at the balance sheet date are as follows:

30 June

2016

31 December

2015

HK$ million

HK$ million

Related parties

14,731

15,469

Third parties

7,370

7,208

22,101

22,677

As at 30 June 2016, the guarantees provided by discontinued operations to related parties of

HK$3,056 million and to third parties of HK$7,251 million were included in the above table

respectively.

The relationship of related parties is disclosed in Note 33.