CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 86

29 Debt instruments issued

(continued)

Notes (continued):

(c)

Subordinated bonds issued

(continued)

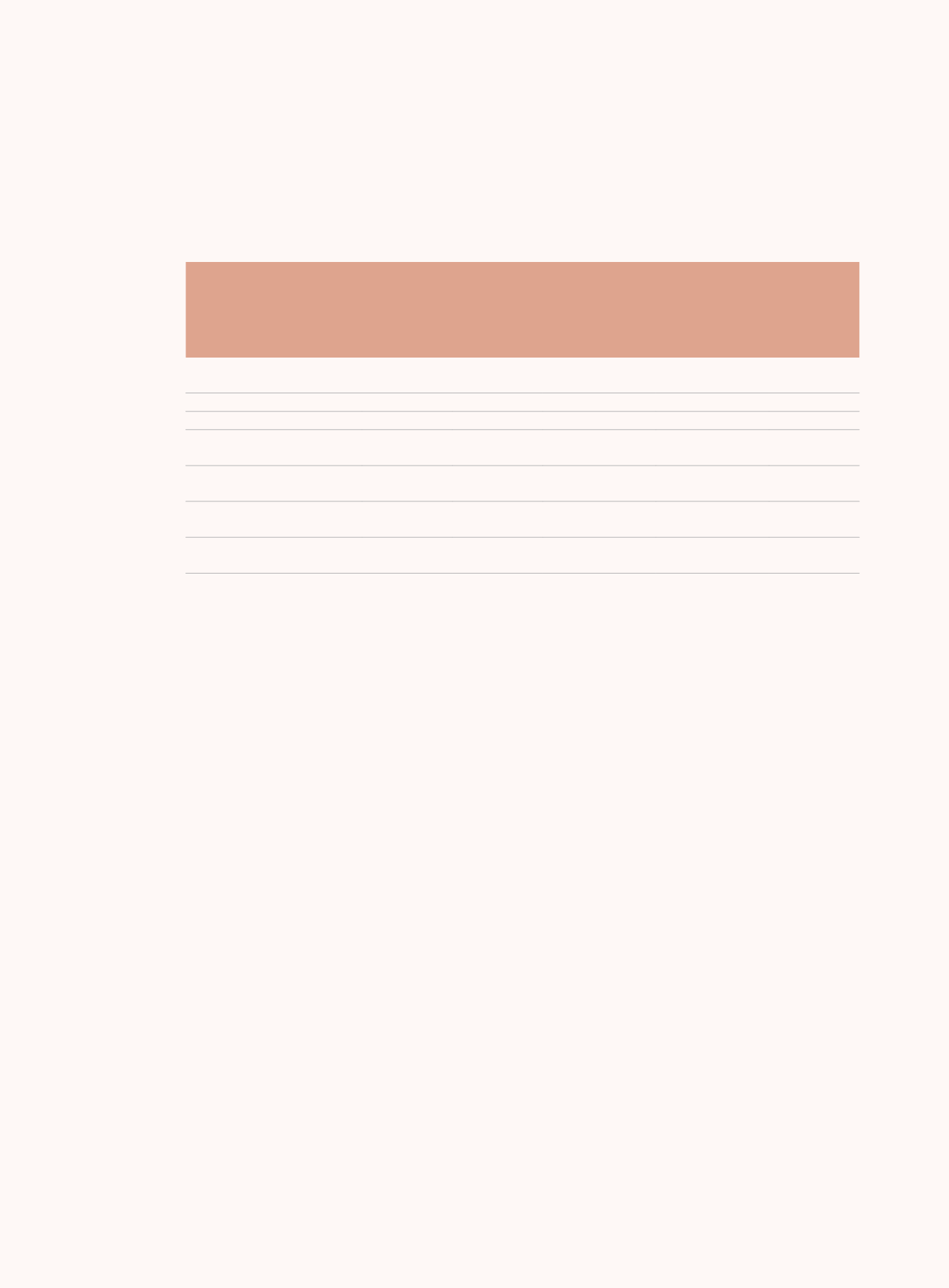

As at 31 December 2015

Denominated

currency

Face value in

denominated

currency

million Issue date

Maturity date

Interest rate

per annum

(i)

Subordinated Notes

US$

500 2010-06-24

2020-06-24

6.88%

(ii)

Subordinated Notes

US$

300 2012-09-27

2022-09-28

3.88%

(iii)

Subordinated Notes

US$

300 2013-11-07

2024-05-07

6.00%

(iv)

Subordinated Fixed Rate

Bonds

RMB

2,000 2006-06-22

2021-06-22

4.12%

(v)

Subordinated Fixed Rate

Bonds

RMB

11,500 2010-05-27

2025-05-28

4.30%

(vi)

Subordinated Fixed Rate

Bonds

RMB

20,000 2012-06-19

2027-06-21

5.15%

(vii) Subordinated Fixed Rate

Bonds

RMB

37,000 2014-08-22

2024-08-26

6.13%

(d)

Certificates of deposit issued

These certificates of deposit were issued by CBI with interest rate ranging from 0.46% to 3.73% per annum (31 December 2015: 0.46% to

3.73% per annum).

(e)

Certificates of interbank deposit issued

As at 30 June 2016, CITIC Bank issued certain certificates of interbank deposit with a total value of RMB291,972 million (approximately

HK$341,620 million) (31 December 2015: RMB171,356 million (approximately HK$204,536 million)). The yield ranges from 2.70% to 3.45%

per annum (31 December 2015: 2.75% to 4.77% per annum). The original expiry terms are between 1 month to 2 years (31 December

2015: between 1 month to 2 years).