CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 88

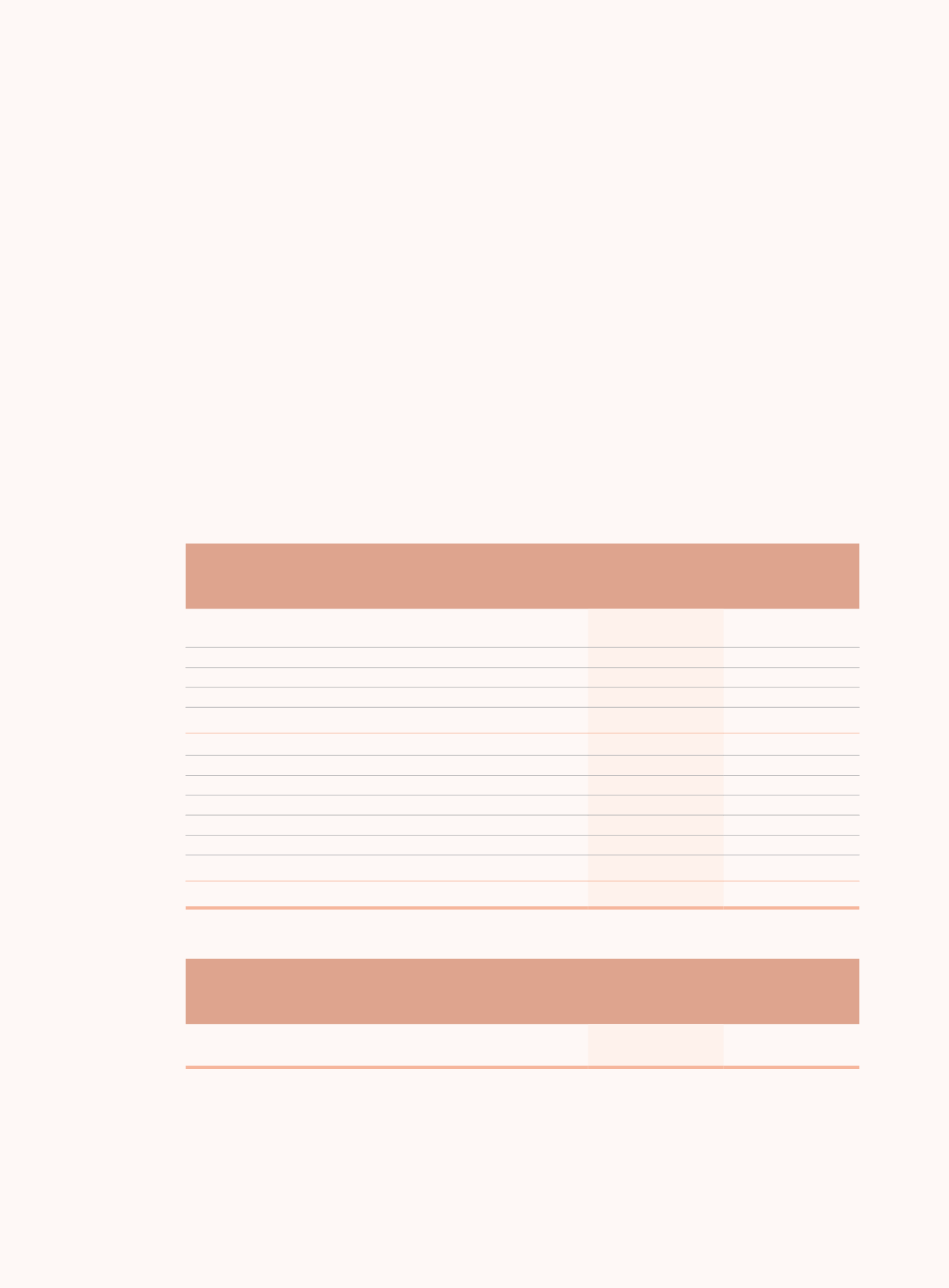

31 Contingent liabilities and commitments

(a) Credit commitments

Credit commitments in connection with the financial services segment of the Group take the form of

loan commitments, credit card commitments, financial guarantees and letters of credit.

Loan commitments represent the undrawn amount of approved loans with signed contracts. Credit

card commitments represent the credit card overdraft limits authorised by the Group. Financial

guarantees and letters of credit represent guarantee provided by the Group to guarantee the

performance of customers to third parties. Acceptances comprise undertakings by the Group to

pay bills of exchange drawn on customers. The Group expects most acceptances to be settled

simultaneously with the reimbursement from the customers.

The contractual amounts of credit commitments by category as at the balance sheet date are set out

below. The amounts disclosed in respect of loan commitments and credit card commitments assume

that amounts are fully drawn down. The amounts of guarantees, letters of credit and acceptances

represent the maximum potential loss that would be recognised as at the balance sheet date if

counterparties failed to perform as contracted.

30 June

2016

31 December

2015

HK$ million

HK$ million

Contractual amount

Loan commitments

With an original maturity of within 1 year

194,302

154,627

With an original maturity of 1 year or above

62,321

83,210

256,623

237,837

Guarantees

178,263

168,190

Letters of credit

105,421

109,784

Acceptances

671,085

753,607

Credit card commitments

220,144

178,015

Others

16

5,040

1,431,552

1,452,473

(b) Credit commitments analysed by credit risk weighted amount

30 June

2016

31 December

2015

HK$ million

HK$ million

Credit risk weighted amount on credit commitments

397,448

467,758

Notes:

(i)

The above credit risk weighted amount is solely in connection with the credit commitments held by CITIC Bank under the

financial services segment of the Group.

(ii)

As at 30 June 2016 and 31 December 2015, the credit risk weighted amount refers to the amount as computed in accordance

with the rules set out by the China Banking Regulatory Commission and depends on the status of counterparties and the

maturity characteristics. The risk weighting used is ranging from 0% to 150%.