CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 90

31 Contingent liabilities and commitments

(continued)

(d) Guarantees provided

(continued)

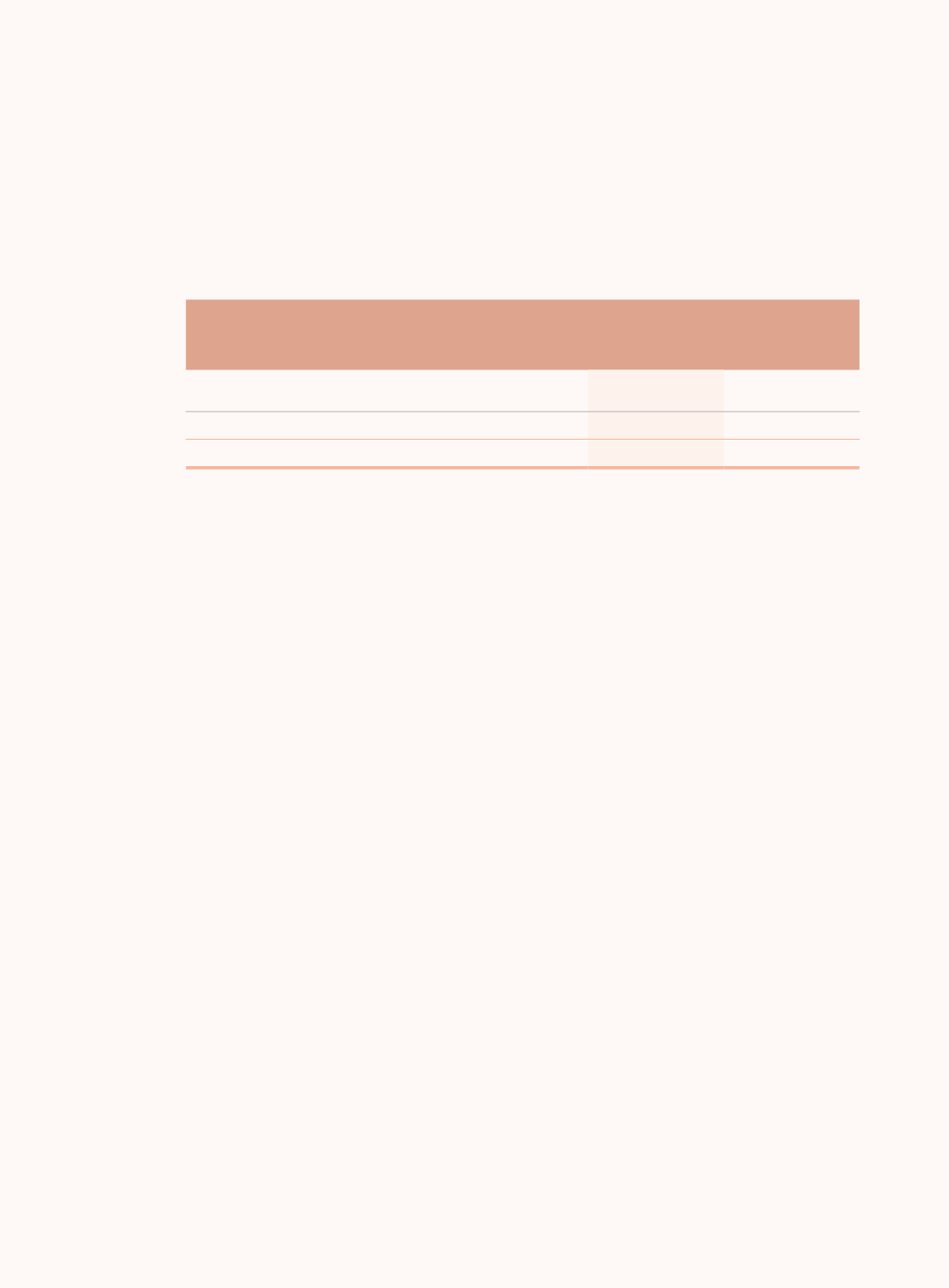

Included in the above table, the Group’s counter guarantees issued to related parties and third

parties as at the balance sheet date are as follows:

30 June

2016

31 December

2015

HK$ million

HK$ million

Related parties

213

146

Third parties

9

99

222

245

(e) Outstanding litigation and disputes

The Group is involved in a number of current and pending legal proceedings. The Group

provided for liabilities arising from those legal proceedings in which the outflow of economic

benefit is probable and can be reliably estimated in the consolidated balance sheet. The Group

believes that these accruals are reasonable and adequate.

(i) The Hong Kong Securities and Futures Commission (the “SFC”) Investigation

Following the Company’s announcement of a foreign exchange related loss, on 22 October

2008, the SFC announced that it had commenced a formal investigation into the affairs of

the Company. On 3 April 2009, the Commercial Crime Bureau of the Hong Kong Police Force

began an investigation of suspected offences relating to the same matter.

The SFC announced on 11 September 2014 that it has commenced proceedings in the

Court of First Instance of the High Court of Hong Kong (the “High Court”) and the Market

Misconduct Tribunal (the “MMT”), respectively, against the Company and five of its former

executive directors.

The SFC alleges that the Company and the former directors had engaged in market

misconduct involving the disclosure of false or misleading information about the Company’s

financial position in connection with losses that the Company had suffered through its

investment in the leveraged foreign exchange contracts.

In the action instigated by the SFC at the MMT, the SFC is asking the MMT to (i) determine

whether any market misconduct has taken place, and (ii) identify persons who had engaged

in such misconduct. In the event that the MMT makes determinations of market misconduct

against either the Company or the former directors, it is understood that the SFC will seek

from the High Court orders against those who have been found to have engaged in market

misconduct to restore affected investors to their pre-transaction positions or to compensate

affected investors for their losses. The SFC has not yet quantified the amount of such

restoration or compensation sought in the proceedings in the High Court, which have been

stayed pending the MMT results.

The MMT hearing was completed in July 2016 with the outcome pending.