HALF-YEAR REPORT 2016

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 65

18 Trade and other receivables

(continued)

(a) Trade and bills receivables

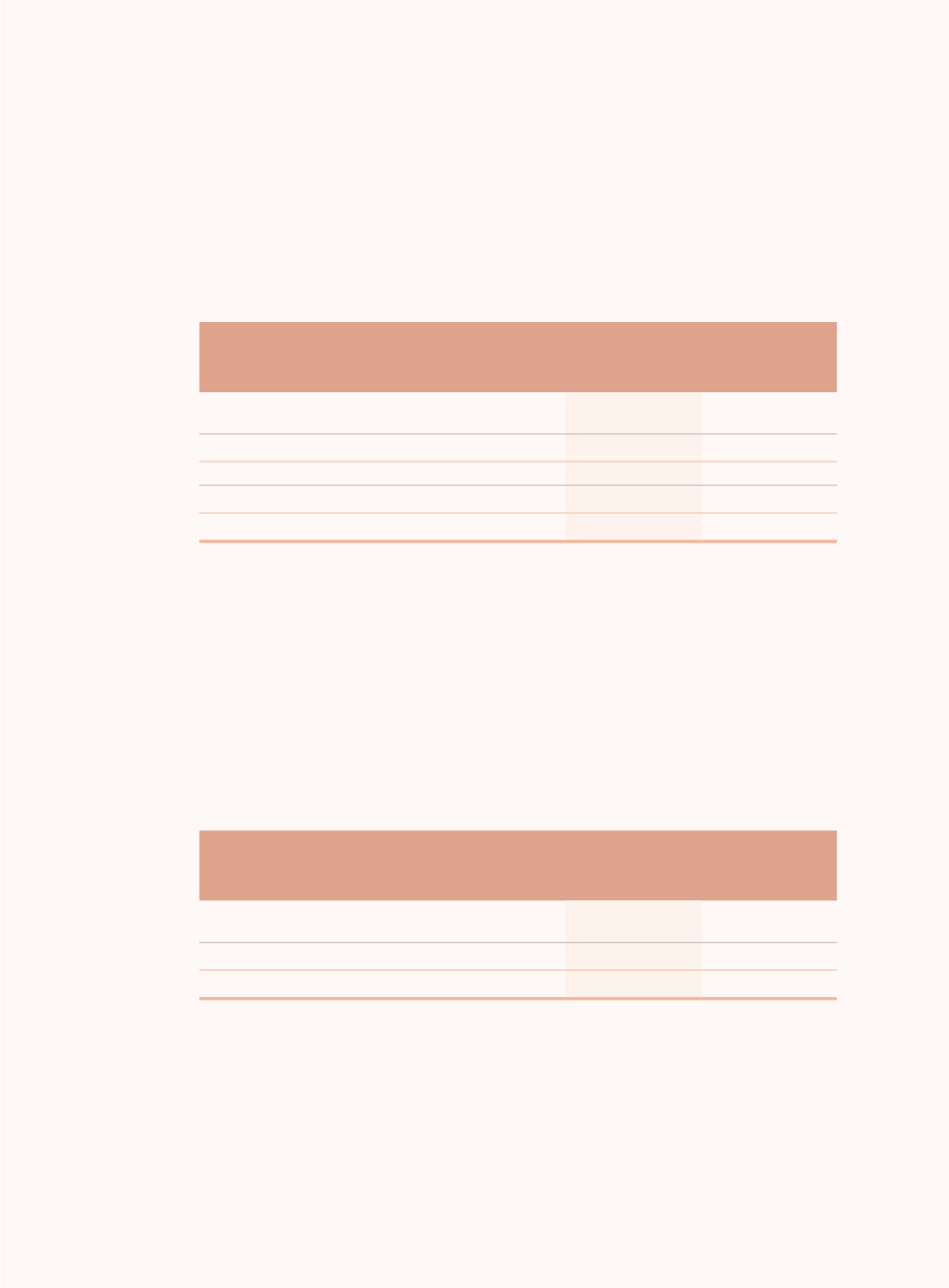

(i) Ageing analysis

As at the balance sheet date, the ageing analysis of trade and bills receivables of the Group

based on invoice date and net of allowance for impairment losses is as follows:

30 June

2016

31 December

2015

HK$ million

HK$ million

Within 1 year

25,196

23,522

Over 1 year

4,957

4,947

30,153

28,469

Less: allowance for impairment losses

(1,190)

(1,136)

28,963

27,333

Each business unit has its own defined credit policy that is specific to the respective business

environment and market practice.

(ii) Impairment of trade and bills receivables

As at 30 June 2016, the Group’s trade and bills receivables of HK$549 million (31 December 2015:

HK$411 million) were individually determined to be impaired. These receivables mainly relate to

customers which were in financial difficulties. It is assessed that a portion of such receivables is

expected to be recovered. Consequently, specific allowance for impairment losses is recognised.

(iii) Trade and bills receivables that are not impaired

The ageing analysis of past due trade and bills receivables that are neither individually nor

collectively considered to be impaired is as follows:

30 June

2016

31 December

2015

HK$ million

HK$ million

Less than 1 year past due

1,097

1,365

Over 1 year past due

259

407

1,356

1,772

Receivables that are past due but not impaired are related to a number of third-party customers

that have a good track record with the Group. Based on past experience, management believes

that no impairment allowance is necessary in respect of these balances as there has not been a

significant change in credit quality and the balances are still considered to be fully recoverable.