HALF-YEAR REPORT 2016

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 63

17 Derivative financial instruments

The Group’s subsidiaries under the financial services segment act as an intermediary to offer derivative

products including forwards and swap of interest rate and currency to its customers. These derivative

positions are managed through entering back-to-back deals with external parties to ensure the remaining

exposures are within acceptable risk levels. Meanwhile, derivatives are also used for proprietary trading

purposes.

Subsidiaries under non-financial services segment of the Group enter into forward and swap contracts to

hedge their exposure to fluctuations in foreign exchange rates, commodity prices and interest rates.

The following tables and notes provide an analysis of the nominal amounts of derivatives and the

corresponding fair values as at the balance sheet date. The nominal amounts of the derivatives indicate the

volume of transactions outstanding as at the balance sheet date; they do not represent amounts at risk.

Hedging instruments are derivatives qualified for hedge accounting, and non-hedging instruments are

derivatives not qualified for hedge accounting.

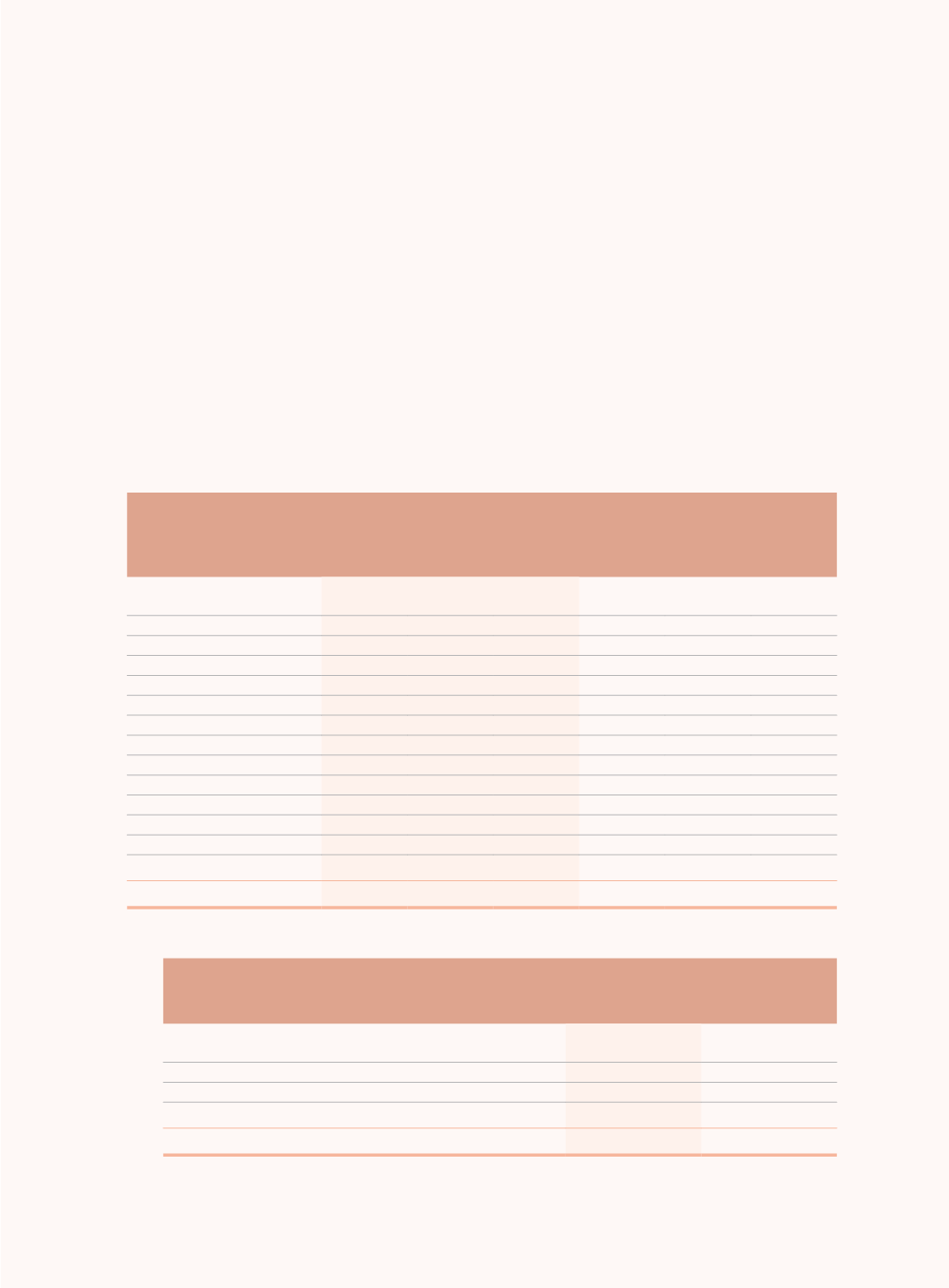

30 June 2016

31 December 2015

Nominal

amount

Assets

Liabilities

Nominal

amount

Assets

Liabilities

HK$ million HK$ million HK$ million

HK$ million HK$ million HK$ million

Hedging instruments

Fair value hedge (note (c)(i)):

– Interest rate derivatives

13,224

398

177

13,302

283

46

– Currency derivatives

1,469

5

–

3,939

48

–

Cash flow hedge (note (c)(ii)):

– Interest rate derivatives

17,416

–

3,380

14,246

–

2,608

– Currency derivatives

1,242

3

4

113

–

2

– Other derivatives

1,380

23

835

24

–

908

Non-hedging instruments

– Interest rate derivatives

816,932

1,296

786

716,684

1,258

1,467

– Currency derivatives

2,344,669

23,293

20,509

1,911,069

13,717

12,082

– Precious metals derivatives

92,108

1,958

7,113

22,396

1,203

362

– Other derivatives

1,528

–

43

6,234

–

–

3,289,968

26,976

32,847

2,688,007

16,509

17,475

(a) Nominal amount analysed by remaining maturity

30 June

2016

31 December

2015

HK$ million

HK$ million

Within 3 months

1,369,112

974,188

Between 3 months and 1 year

1,677,818

1,560,625

Between 1 year and 5 years

229,407

144,900

Over 5 years

13,631

8,294

3,289,968

2,688,007

The remaining term to maturity of derivatives does not represent the Group’s intended holding

period.