CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 60

14 Segment reporting

(continued)

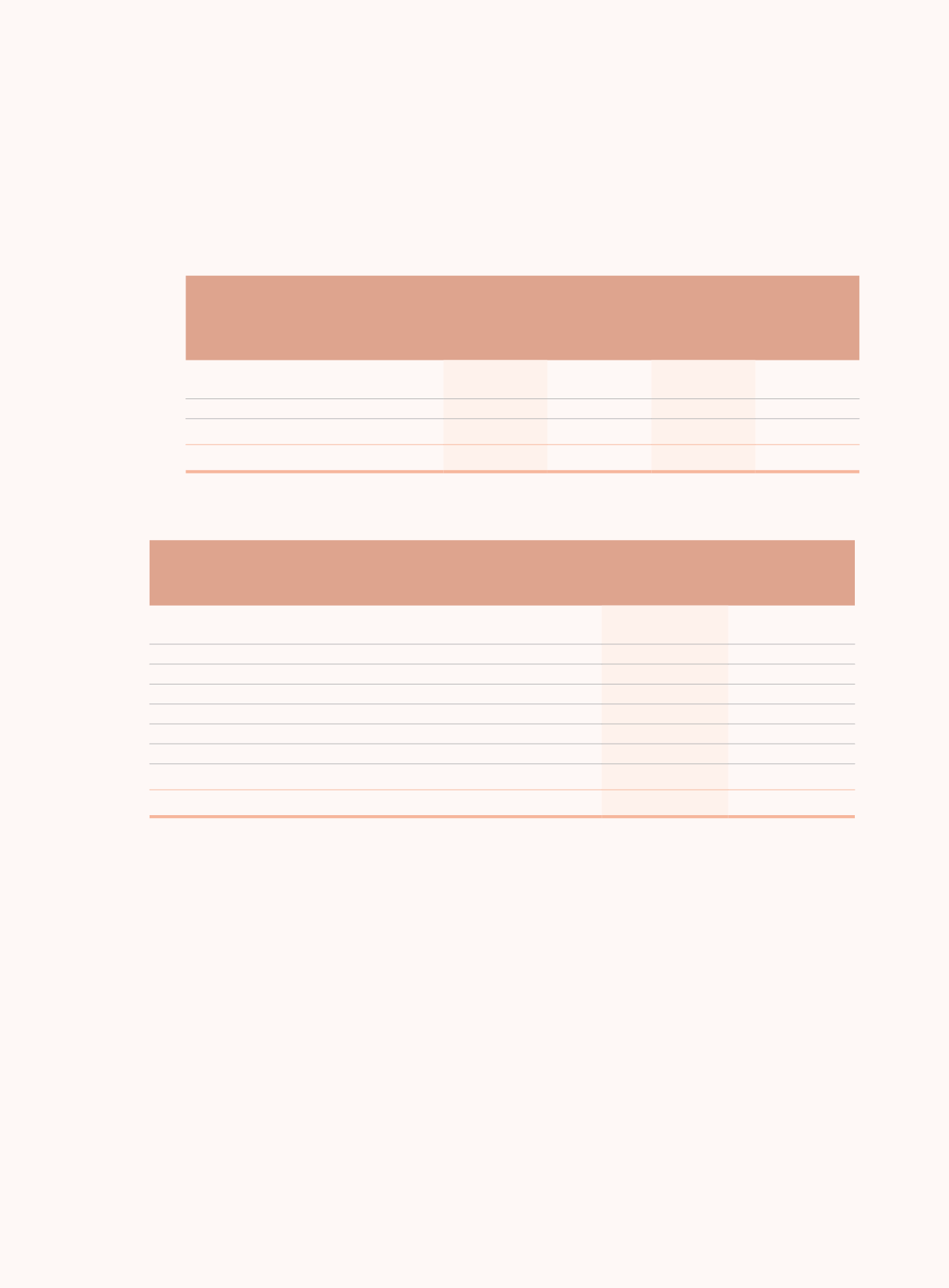

(b) Geographical information

An analysis of the Group’s revenue and total assets by geographical area are as follows:

Revenue from external customers Reportable segment assets

Six months ended 30 June

30 June

31 December

2016

2015 (Restated)

2016

2015

HK$ million

HK$ million

HK$ million

HK$ million

Mainland China

155,249

162,847

6,758,928

6,312,332

Hong Kong and Macau

16,797

20,391

383,789

380,549

Overseas

11,928

13,324

122,100

110,428

183,974

196,562

7,264,817

6,803,309

15 Cash and deposits

30 June

2016

31 December

2015

HK$ million

HK$ million

Cash

7,937

8,827

Bank deposits

62,521

63,166

Balances with central banks (note (i)):

– Statutory deposit reserve funds (note (ii))

512,644

519,487

– Surplus deposit reserve funds (note (iii))

173,102

75,983

– Foreign exchange reserves (note (iv))

16,909

4,078

– Fiscal deposits (note (v))

8,746

4,532

Deposits with banks and non-bank financial institutions

91,667

125,542

873,526

801,615

Notes:

(i)

The balances with central banks represent deposits placed with central banks by China CITIC Bank Corporation Limited (“CITIC Bank”)

and CITIC Finance Company Limited (“CITIC Finance”).

(ii)

CITIC Bank and CITIC Finance place statutory deposit reserves with the People’s Bank of China and overseas central banks where they

have operations. The statutory deposit reserves are not available for use in their daily business.

As at 30 June 2016, the statutory deposit reserve placed by CITIC Bank with the People’s Bank of China was calculated at 15% (31

December 2015: 15%) of eligible RMB deposits for domestic branches of CITIC Bank, and at 15% (31 December 2015: 0%) of eligible RMB

deposits from overseas financial institutions respectively. In addition, CITIC Bank is required to deposit an amount equivalent to 5% (31

December 2015: 5%) of its foreign currency deposits from domestic branch customers as statutory deposit reserve as at 30 June 2016.

As at 30 June 2016, the statutory RMB deposit reserve rate applicable to Zhejiang Lin’an CITIC Rural Bank Corporation Limited, a

subsidiary of CITIC Bank, was at 9% (31 December 2015: 9.5%).

The amounts of statutory deposit reserves placed with the central banks of overseas countries are determined by local jurisdictions. The

foreign currency reserve deposits placed with the People’s Bank of China are non-interest bearing.

As at 30 June 2016, the statutory deposit reserve placed by CITIC Finance with the People’s Bank of China was calculated at 7% (31

December 2015: 7.5%) of eligible RMB deposits from the customers of CITIC Finance. As at 30 June 2016, CITIC Finance is also required

to deposit an amount equivalent to 5% (31 December 2015: 5%) of its foreign currency deposits from the customers as statutory deposit

reserve.