CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 54

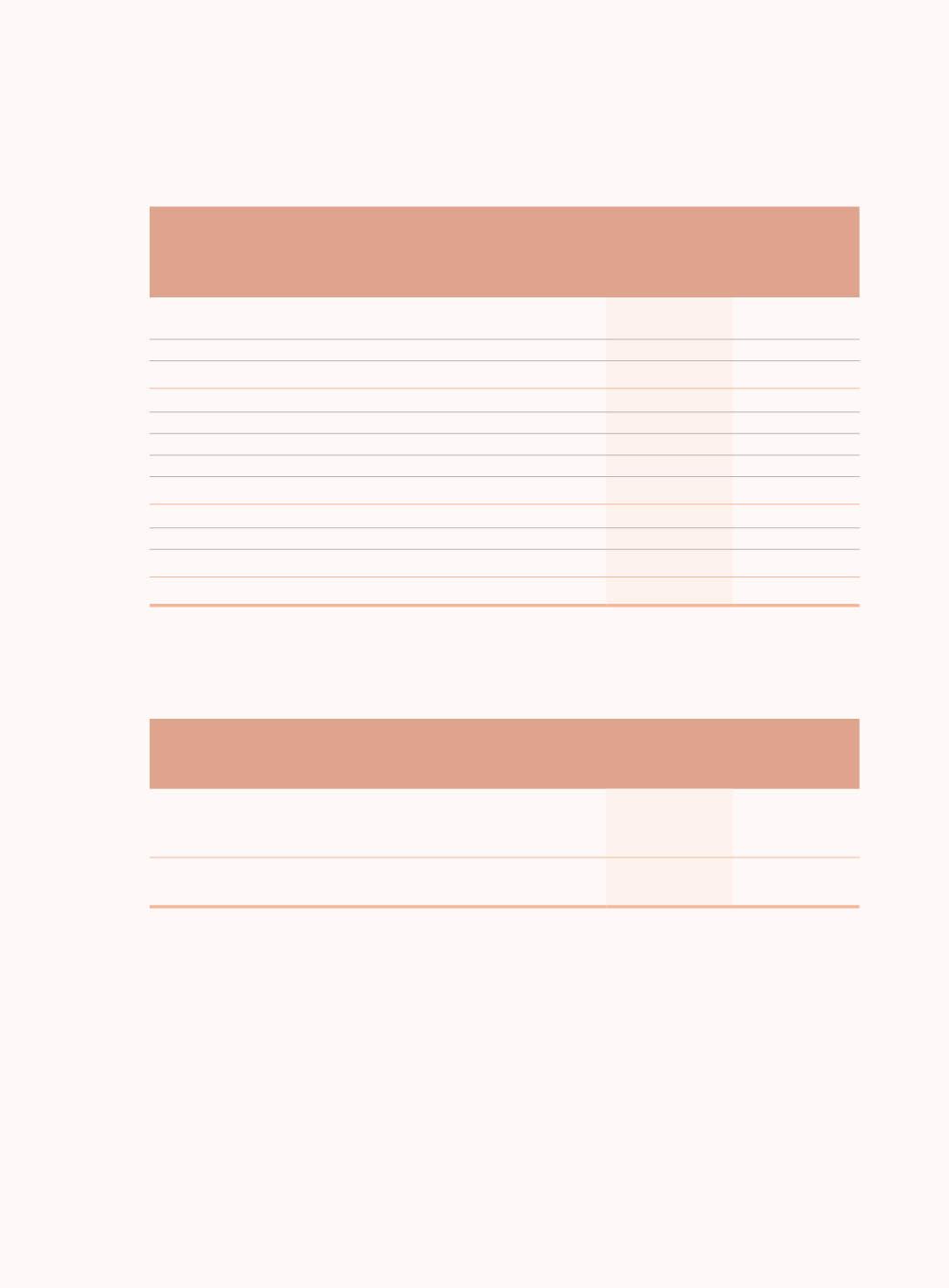

10 Income tax expense

Six months ended 30 June

2016

2015

HK$ million

HK$ million

(Restated)

Current tax – Mainland China

Provision for enterprise income tax

10,796

13,287

Land appreciation tax

48

24

10,844

13,311

Current tax – Hong Kong

Provision for Hong Kong profits tax

953

470

Current tax – Overseas

Provision

273

393

12,070

14,174

Deferred tax

Origination and reversal of temporary differences

273

(977)

12,343

13,197

The particulars of the applicable income tax rates are disclosed in Note 4.

11 Dividends

Six months ended 30 June

2016

2015

HK$ million

HK$ million

2015 Final dividend paid: HK$0.20

(2014: HK$0.20) per share

5,818

4,981

2016 Interim dividend proposed: HK$0.10

(2015: HK$0.10) per share

2,909

2,909