HALF-YEAR REPORT 2016

/ 25

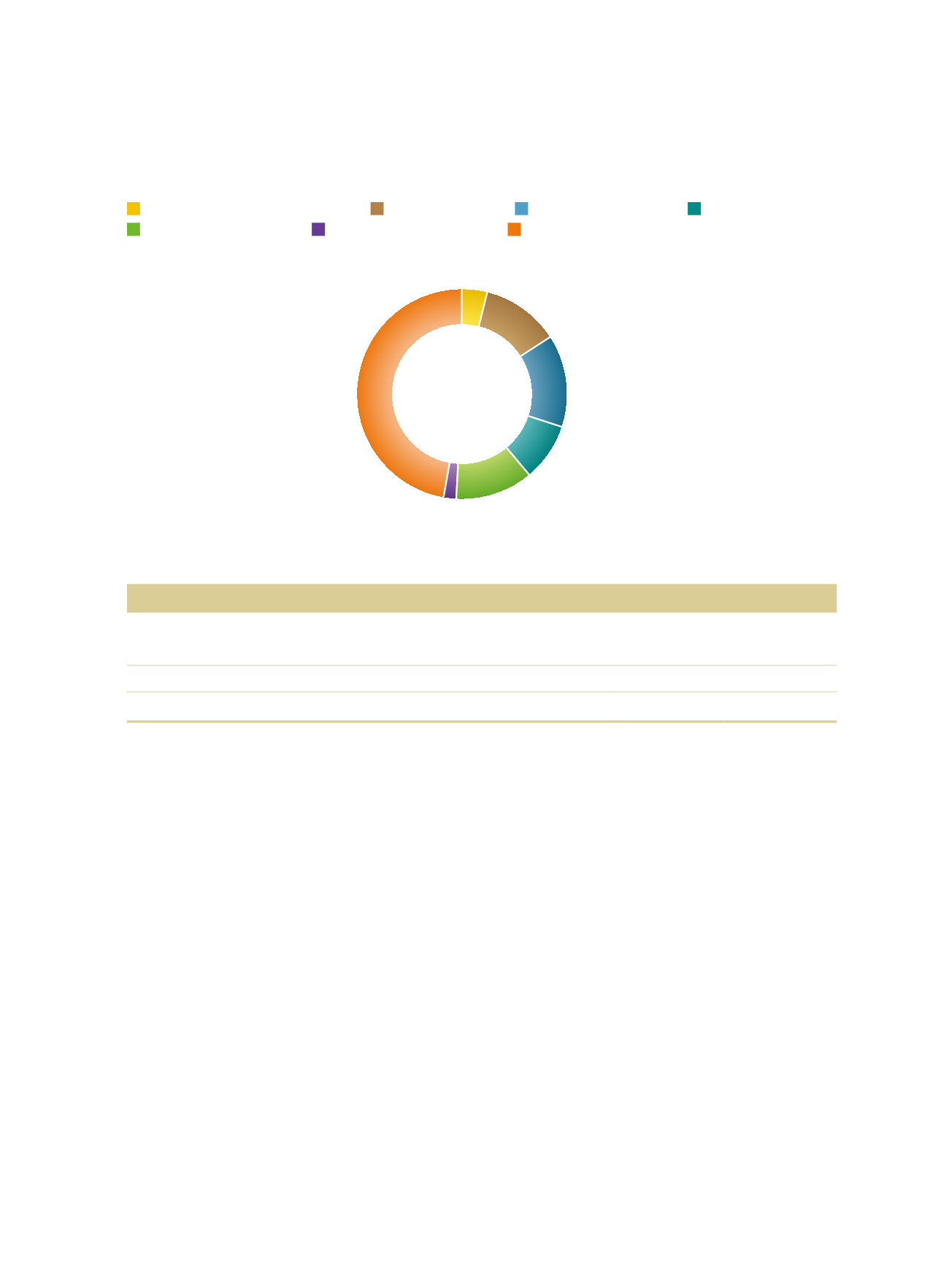

Consolidated debt by type as at 30 June 2016

Loan within one year or on demand

Loan over one year

Corporate bonds issued

Notes issued

Subordinated debt issued

Certificate of deposit issued

Interbank CD

4%

12%

14%

9%

12%

2%

47%

The debt to equity ratio of CITIC Limited as at 30June 2016 is as follows:

In HK$ million

Consolidated Head office

Debt

719,877

66,047

Total equity

(5)

655,617

389,589

Debt to equity ratio

110%

17%

Note:

(5)

Total consolidated equity is based on the “total equity” in the Consolidated Balance Sheet; Total equity of head office is based

on the “total ordinary shareholders’ funds and perpetual capital securities” in the Balance Sheet.

2.

Liquidity risk management

The objective of liquidity risk management is to ensure that CITIC Limited always has sufficient cash to

repay its maturing debt, perform other payment obligations and meet other funding requirements for

normal business development.

CITIC Limited’s liquidity management involves the regular cash flow forecast for the next three years

and the consideration of its liquid assets level and new financings necessary to meet future cash flow

requirements.

CITIC Limited centrally manages its own liquidity and that of its major non-financial subsidiaries and

improves the efficiency of fund utilisation. With flexible access to domestic and overseas markets, CITIC

Limited seeks to diversify sources of funding through different financing instruments, in order to raise low-

cost funding of medium and long terms, maintain a mix of staggered maturities and minimise refinancing

risk.

Details of liquidity risk management are set out in Note 32(b) to the consolidated financial statements.