CITIC LIMITED

/ 24

1.

Debt

ALCO centrally manages and regularly monitors the existing and projected debt levels of CITIC Limited

and its major non-financial subsidiaries to ensure that the Group’s debt size, structure and cost are at

reasonable levels.

As at 30 June 2016, consolidated debt of CITIC Limited

(1)

was HK$719,877 million, including loans of

HK$110,779 million and debt instruments issued

(2)

of HK$609,098 million. Debt of the head office of CITIC

Limited

(3)

accounted for HK$66,047 million and debt of CITIC Bank

(4)

HK$480,212 million. In addition, the

head office of CITIC Limited had cash and deposits of HK$4,829 million and available committed facilities

from banks and subsidiaries of HK$17,000 million.

The details of debt are as follows:

As at 30 June 2016

HK$ million

Consolidated debt of CITIC Limited

719,877

Among which: Debt of the head office of CITIC Limited

66,047

Debt of CITIC Bank

480,212

Note:

(1)

Consolidated debt of CITIC Limited is the sum of “bank and other loans” and “debt instruments issued” in the Consolidated

Balance Sheet of CITIC Limited;

(2)

Debt instruments issued include corporate bonds, notes, subordinated bonds, certificates of deposit and certificates of

interbank deposit issued;

(3)

Debt of the head office of CITIC Limited is the sum of “bank and other loans”, “long-term borrowings” and “debt instruments

issued” in the Balance Sheet of CITIC Limited;

(4)

Debt of CITIC Bank refers to CITIC Bank’s consolidated debt securities issued, including long-term debt securities, subordinated

bonds, certificates of deposit and certificates of interbank deposit issued.

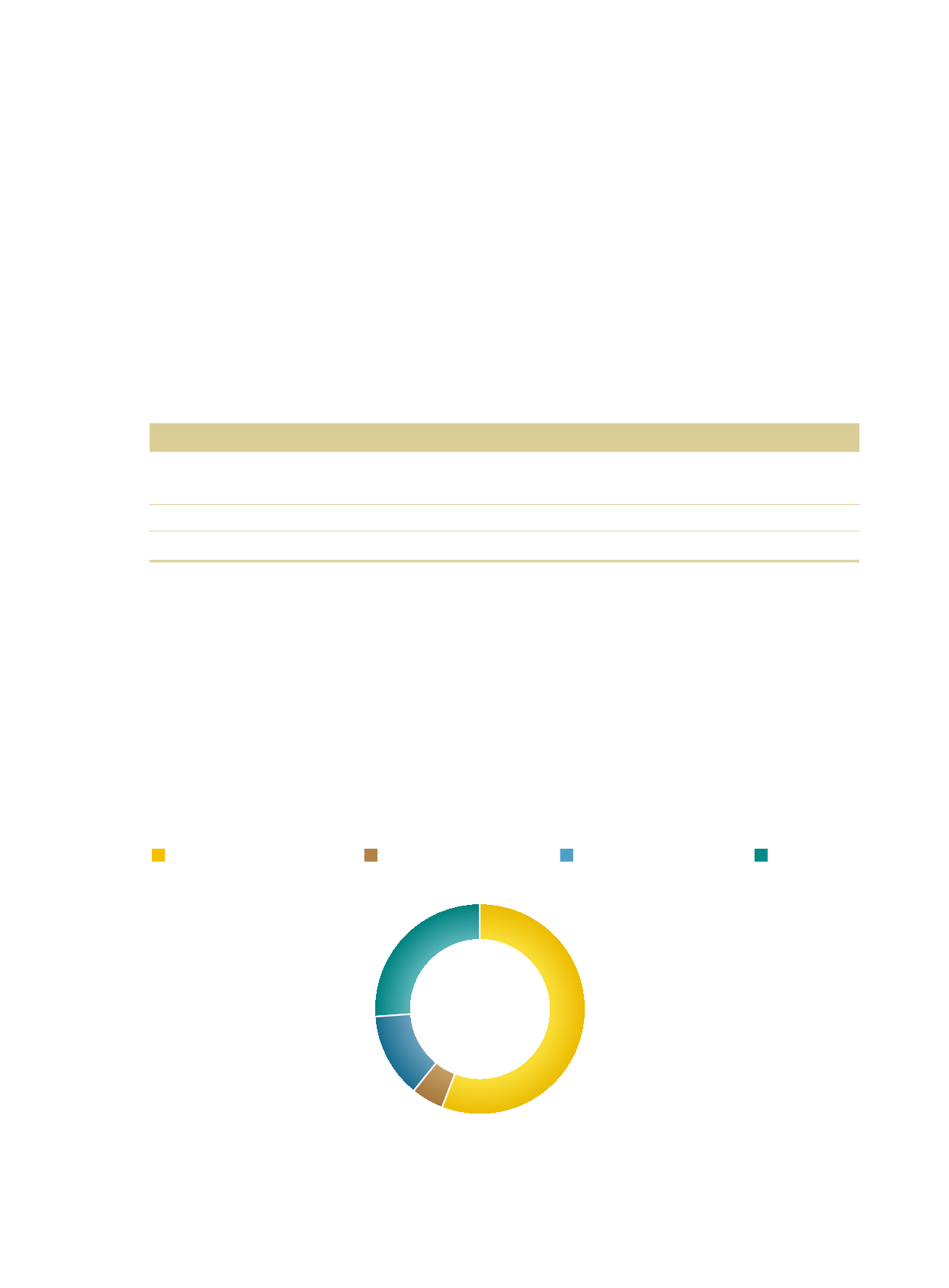

Consolidated debt by maturity as at 30 June 2016

Within one year or on demand

Between one and two years

Between two and five years

Over five years

56%

5%

13%

26%