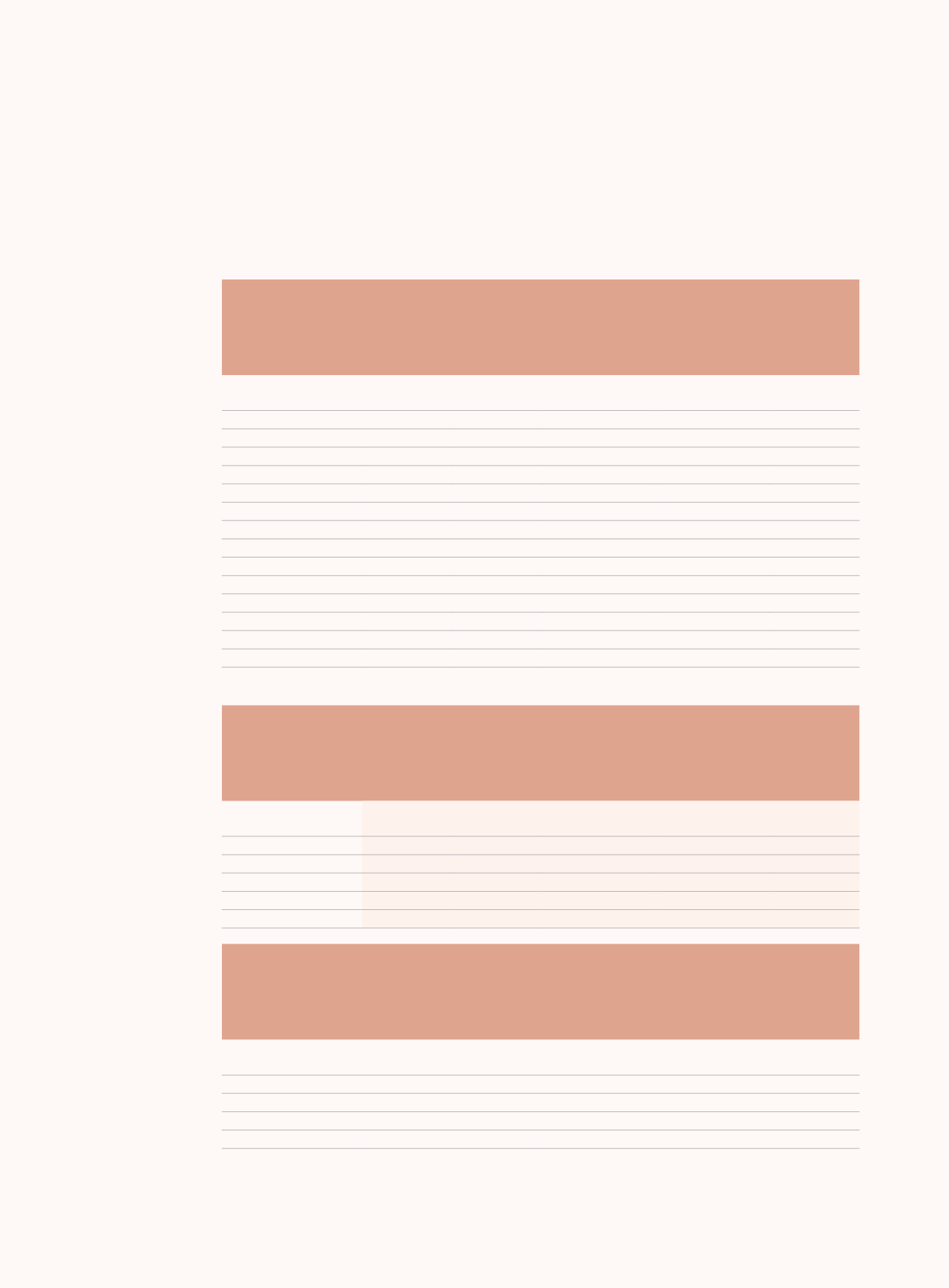

CITIC LIMITED

Notes to the Consolidated Financial Statements

For the six months ended 30 June 2016

/ 80

29 Debt instruments issued

(continued)

Notes (continued):

(a)

Corporate bonds issued

(continued)

(i)

Details of corporate bonds issued by the Company

(continued)

As at 31 December 2015

Denominated

currency

Face value in

denominated

currency

million Issue date

Maturity date

Interest rate

per annum

RMB Notes 1

RMB

1,000 2011-08-03

2016-08-03

2.70%

US$ Notes 3.1

US$

750 2012-03-21

2018-01-21

6.88%

US$ Notes 3.2

US$

350 2012-04-26

2018-01-21

6.88%

HK$ Notes 1

HK$

500 2013-07-31

2018-07-31

5.90%

US$ Notes 5

US$

500 2013-04-10

2020-04-10

6.38%

US$ Notes 2.1

US$

500 2011-04-15

2021-04-15

6.63%

US$ Notes 2.2

US$

250 2014-06-23

2021-04-15

6.63%

US$ Notes 1

US$

150 2010-08-16

2022-08-16

6.90%

US$ Notes 4.1

US$

750 2012-10-17

2023-01-17

6.80%

US$ Notes 4.2

US$

250 2012-12-11

2023-01-17

6.80%

US$ Notes 4.3

US$

400 2014-07-18

2023-01-17

6.80%

US$ Notes 6.1

US$

110 2014-07-18

2024-01-18

4.70%

US$ Notes 6.2

US$

90 2014-10-29

2024-01-18

4.70%

HK$ Notes 2

HK$

420 2014-07-25

2024-07-25

4.35%

US$ Notes 7

US$

280 2015-04-14

2035-04-14

4.60%

(ii)

Details of corporate bonds issued by CITIC Corporation

As at 30 June 2016

Denominated

currency

Face value in

denominated

currency

million Issue date

Maturity date

Interest rate

per annum

02 CITIC bond

RMB

4,500 2002-09-26

2017-09-26

4.08%

03 CITIC bond-2

RMB

6,000 2003-12-10

2023-12-09

5.10%

05 CITIC bond-2

RMB

4,000 2005-12-07

2025-12-06

4.60%

16 CITIC stock SCP001

RMB

10,000 2016-04-12

2016-12-07

2.55%

16 CITIC stock SCP002

RMB

5,000 2016-04-26

2016-10-22

2.75%

Samurai bond

JPY

10,000 1996-09-19

2016-09-18

4.95%

As at 31 December 2015

Denominated

currency

Face value in

denominated

currency

million Issue date

Maturity date

Interest rate

per annum

02 CITIC bond

RMB

4,500 2002-09-26

2017-09-26

4.08%

03 CITIC bond-2

RMB

6,000 2003-12-10

2023-12-09

5.10%

05 CITIC bond-2

RMB

4,000 2005-12-07

2025-12-06

4.60%

15 CITIC bond-SCP001

RMB

3,000 2015-04-20

2016-01-17

4.18%

Samurai bond

JPY

10,000 1996-09-19

2016-09-18

4.95%